Tip #70 – “Mystery Profits” May Not Be Recognized By Buyers For The Business – And Certainly Not By Lenders!

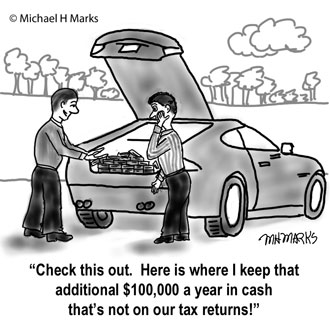

In order to avoid taxes, some business owners have found ways to hide what should have been shown as profits.

In order to avoid taxes, some business owners have found ways to hide what should have been shown as profits.

Sometimes it’s pocketing cash, sometimes it’s moving revenues into another year, and other creative ways. But when it comes time to claim how profitable the company really is, buyers aren’t buying it, lenders turn their heads and laugh, and due diligence can destroy a deal.

In order to get that top dollar price, businesses must show all profits over a period of years.