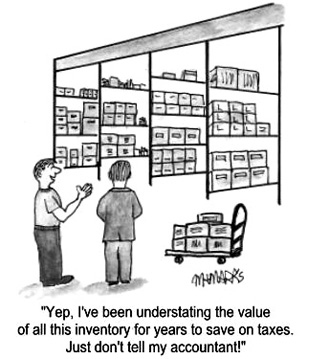

Reporting a lower inventory to their accountant is something many business owners have been doing for a long time. And many accountants just accept the number.

Reporting a lower inventory to their accountant is something many business owners have been doing for a long time. And many accountants just accept the number.

In addition to the obvious concerns, when it comes to selling the business, big problems can arise. How will the inventory be valued in the Purchase Allocations? And who is going to have to pay the various taxes on the larger amount?

Business owners should give their accountants an accurate inventory value each year to avoid troubles at the closing table!

Michael Marks, creator of Toons ‘n Tips, is a Certified Business Intermediary (CBI) and has over thirty-six years of business experience and ownership. He is a licensed real estate broker in the state of Colorado and has been selling businesses for over eighteen years. Michael has taken up cartooning as a hobby in recent years and has found that by using those skills, along with his extensive business experience, he has been able to create the Toons ‘n Tips drip marketing service for clients all over the country. Find out more about Michael at www.toonsntips.com. Michael Marks, creator of Toons ‘n Tips, is a Certified Business Intermediary (CBI) and has over thirty-six years of business experience and ownership. He is a licensed real estate broker in the state of Colorado and has been selling businesses for over eighteen years. Michael has taken up cartooning as a hobby in recent years and has found that by using those skills, along with his extensive business experience, he has been able to create the Toons ‘n Tips drip marketing service for clients all over the country. Find out more about Michael at www.toonsntips.com. |