Tip #101 – Is It A Business That Buyers Could Get Excited About?

Like everything else in this world, people react to something that they are attracted to and that gets them excited.

Like everything else in this world, people react to something that they are attracted to and that gets them excited.

Even though buying a business should be a logical decision, there is a certain amount of emotion involved. The businesses that attract the most buyers and bring the highest prices usually have great appeal and a strong future. That can mean something special, something visual, or more importantly, good solid profitability.

Business owners who are anticipating selling their company must […]

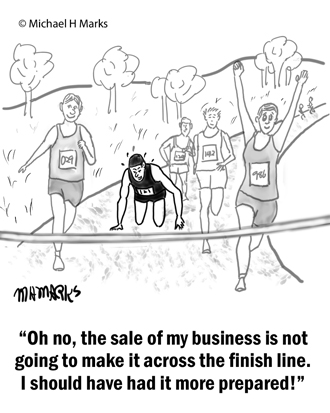

Like long distance runners, business owners who want to sell their business need to prepare their company for the big event.

Like long distance runners, business owners who want to sell their business need to prepare their company for the big event. Owning a business is usually a very big part of the owner’s life. But over time, managing the business can take a toll on the owner.

Owning a business is usually a very big part of the owner’s life. But over time, managing the business can take a toll on the owner. Selling a business can take more time than is anticipated. For some businesses, it can take months just to find a motivated, qualified buyer.

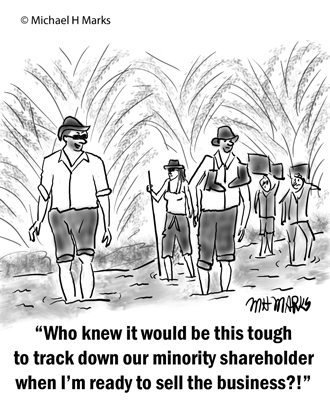

Selling a business can take more time than is anticipated. For some businesses, it can take months just to find a motivated, qualified buyer. If there is a minority shareholder in a business, he or she may need to be consulted before selling the company.

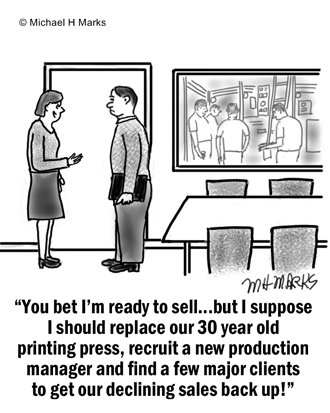

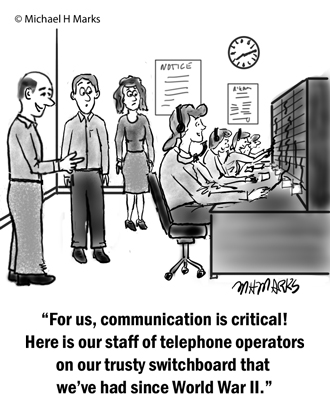

If there is a minority shareholder in a business, he or she may need to be consulted before selling the company. We all know that technology is moving so fast it can be overwhelming. And it is impacting many businesses in a way that business owners just can’t ignore.

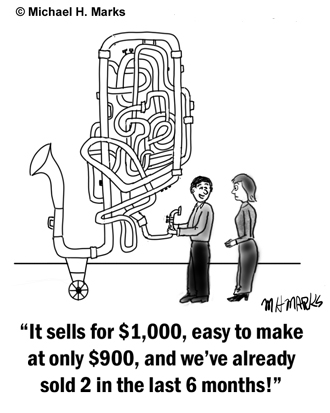

We all know that technology is moving so fast it can be overwhelming. And it is impacting many businesses in a way that business owners just can’t ignore. Buyers will make an acquisition of a business only when it makes financial sense.

Buyers will make an acquisition of a business only when it makes financial sense. It is wise when starting and growing a business to have the objective of selling it someday at maximum value. That means that the company should be built with good profit margins, large available markets and the ability to grow for a long period of time.

It is wise when starting and growing a business to have the objective of selling it someday at maximum value. That means that the company should be built with good profit margins, large available markets and the ability to grow for a long period of time. Selling a business is usually not easy. It can be a complicated process because of all of the many elements to a business – location, leases, equipment, employees, receivables, payables, etc., etc.

Selling a business is usually not easy. It can be a complicated process because of all of the many elements to a business – location, leases, equipment, employees, receivables, payables, etc., etc. Business owners don’t always understand how business valuations are performed, and they oftentimes don’t agree with the number.

Business owners don’t always understand how business valuations are performed, and they oftentimes don’t agree with the number.