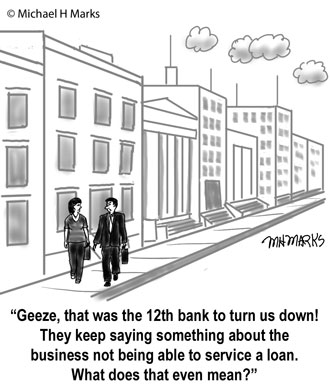

There are many reasons that buyers of businesses are turned down for acquisition loans. Oftentimes the price of the business is too high and the cash flow of the business can’t support servicing of the debt.

There are many reasons that buyers of businesses are turned down for acquisition loans. Oftentimes the price of the business is too high and the cash flow of the business can’t support servicing of the debt.

Sometimes the assets to be used for collateral are inadequate. But the banks and the SBA look at other criteria, such as the buyer’s credit rating and their qualifications to operate and manage the business.

At the very least, business owners must make sure their company fits all the criteria that banks are looking for in order to find a buyer that will qualify for a loan.

Read about SBA Business Loan Eligibility here.

Michael Marks, creator of Toons ‘n Tips, is a Certified Business Intermediary (CBI) and has over thirty-six years of business experience and ownership. He is a licensed real estate broker in the state of Colorado and has been selling businesses for over eighteen years. Michael has taken up cartooning as a hobby in recent years and has found that by using those skills, along with his extensive business experience, he has been able to create the Toons ‘n Tips drip marketing service for clients all over the country. Find out more about Michael at www.toonsntips.com. Michael Marks, creator of Toons ‘n Tips, is a Certified Business Intermediary (CBI) and has over thirty-six years of business experience and ownership. He is a licensed real estate broker in the state of Colorado and has been selling businesses for over eighteen years. Michael has taken up cartooning as a hobby in recent years and has found that by using those skills, along with his extensive business experience, he has been able to create the Toons ‘n Tips drip marketing service for clients all over the country. Find out more about Michael at www.toonsntips.com. |