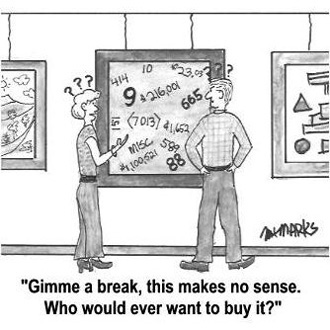

Vail Valley Restaurant/Bar With High Profits – $240,000 Earnings! #1468a

No Longer Available

Details

| Asking Price: |

$899,000 |

| Annual Sales: |

$1,334,000 |

| Cash Flow: |

$243,400 |

| Inventory: | $30,000* |

| FF&E & Leaseholds: | $200,000* |

| Real Estate: | N/A |

| Employees: | 15-20 FT/PT |

| Location: | Avon, CO |

| *Included |