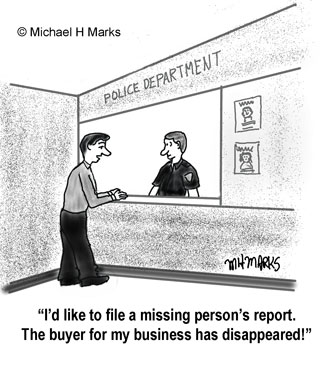

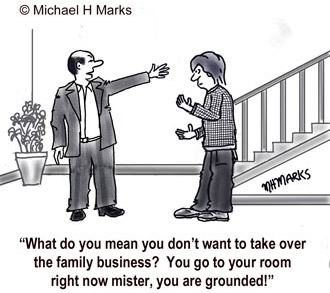

Tip #60 – Why Does It Take So Long To Sell A Business?

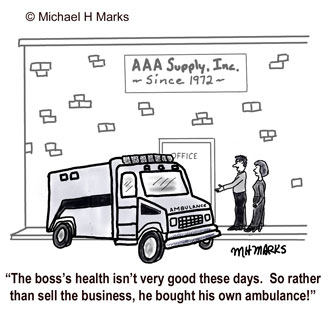

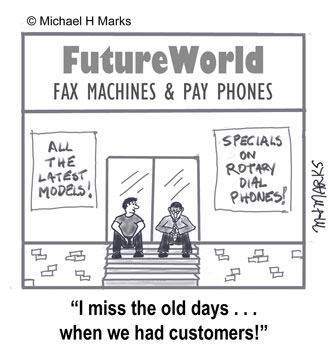

Business Owners must be aware that the process of selling a business is complex and can take time. Each business is unique and there are many steps along the way – particularly if the deal includes outside lender financing.

Business Owners must be aware that the process of selling a business is complex and can take time. Each business is unique and there are many steps along the way – particularly if the deal includes outside lender financing.

If a business shows strong cash flow, it usually will sell quicker. And when the financials are clean and straight forward, it makes it much easier. Business owners must prepare their business for sale so it looks attractive to buyers. Profitability and anticipation of […]